24+ Netherlands Tax Calculator

For example if the declared value of your. How Blue Umbrellas income tax calculator works.

India Entry Strategy Brochure

Check the I enjoy the 30 ruling and find the maximum.

. The salary amount does not matter if working with scientific research. Select your income source Employed or Self-Employed. The 30 Tax Ruling basically stipulates that 30 of your income will be tax free hence your taxable gross income becomes 70 of your stipulated gross income.

To calculate the tax. From there you will see which of the Netherlands 4 income housing tax brackets you fall under and the rates at which you will be taxed. Security Tax -9808.

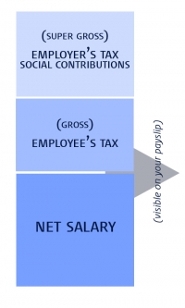

Dutch Income Tax Calculator Calculations for 2023 About 30 Ruling The salary criteria for the 30 ruling as per January 2023 are as follows. Expenditure on the study medical etc. The Dutch income tax calculator provides you with a net salary based on the details you put in the calculator.

And if you want to preserve the. The import tax charged on a shipment will be 21 on the full value of your items. Up to 80 cash back The Tax Free Threshold Is 0 EUR.

For older cars and motorbikes its calculated based on their list prices. If you want to fully understand how Dutch taxes work read the taxes page. Payroll Tax -5761.

Labour Tax Credit. The annual taxable salary. The salary criteria for the 30 ruling as per January 2023 are as follows.

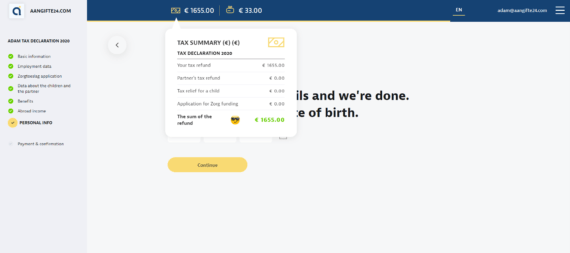

The more expensive and better equipped the vehicle the higher the tax you will pay. The Dutch tax refund calculator is the only English tool available online that accurately estimates amounts included in the decision. 1 20043 3710 includes social security.

Income Tax Calculator Netherlands Use our Dutch tax calculator to find out how much income tax you pay in the Netherlands. There is no need to wait for information from the Tax Office. In the near future I will add a pension calculator and a special bonus calculator.

It is therefore good to know that a foreign employer in the Netherlands may. Extra income or savings. The salary amount does not matter if working.

The Annual Wage Calculator is updated with the latest income tax rates in the Netherlands for 2022 and is a great calculator for working out your income tax and salary after tax based on a.

Dutch 2021 Tax Bill Presented Lexology

Wsis Stocktaking 2020 Global Report Zero Draft

Quick Tax Refund If You Worked In Netherlands Rt Tax

Pdf Phonetic Implementation Of Phonological Categories In Sign Language Of The Netherlands Onno Crasborn Academia Edu

Dutch Income Tax Calculator Dutch Umbrella Company

Dutch Income Tax Calculator I Expat Service

Dutch Income Tax Calculator

Dutch Salary Tax Calculator 2022 Access Financial

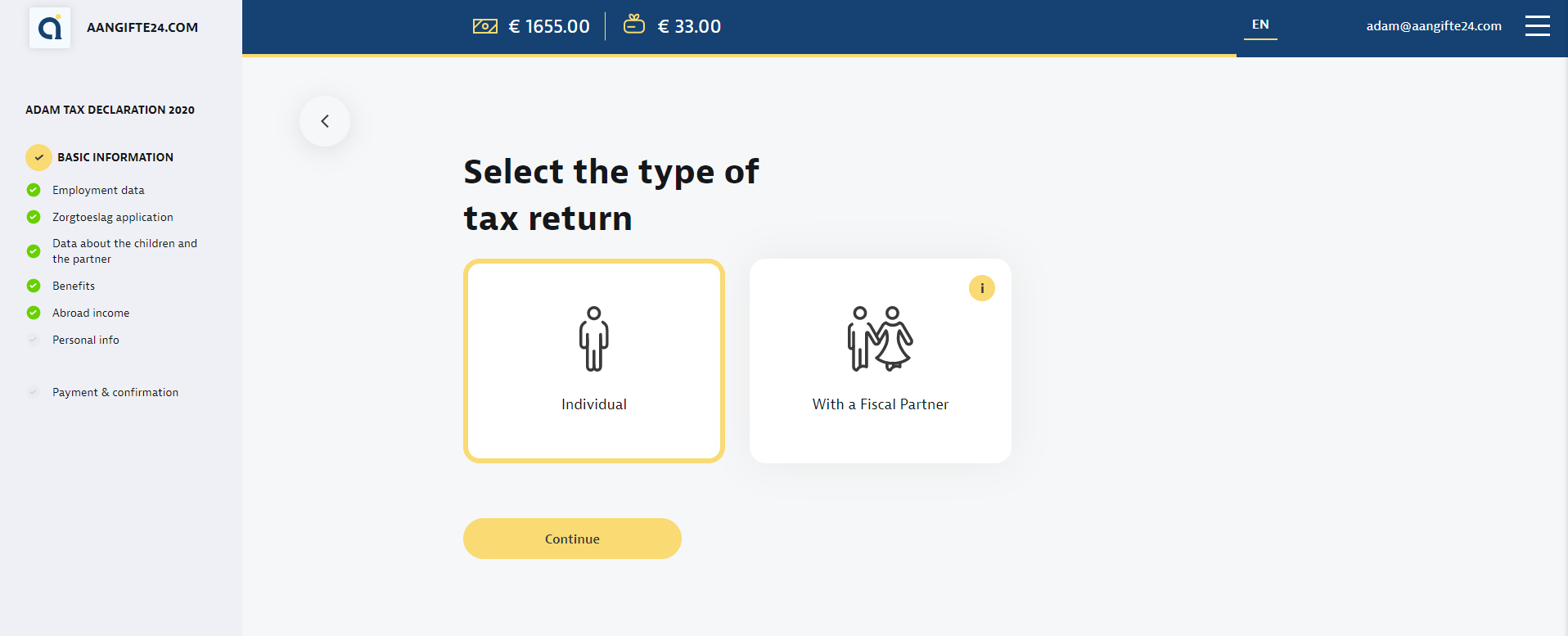

Tax Calculator Netherlands Aangifte24

Falling Living Standards During The Covid 19 Crisis Quantitative Evidence From Nine Developing Countries Science Advances

Cryptocurrency And Taxation In The Netherlands Ir Global

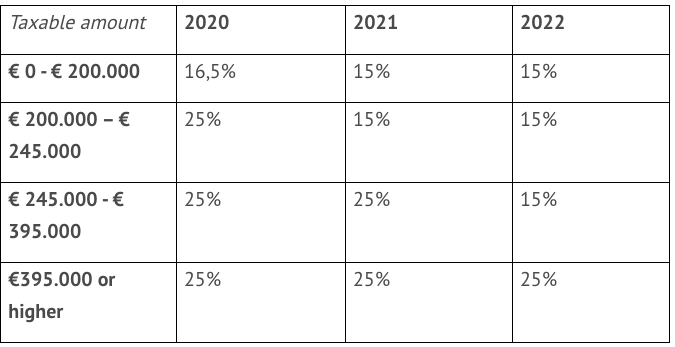

Personal Income Tax Rates Taxable

Dutch Income Tax Calculator I Expat Service

Tax Calculator Netherlands Aangifte24

Taxes And Social Security Leiden University

Breakbulk Europe 2017 Event Guide By Breakbulk Events Media Issuu

Annual Report In Estonia 10 Questions From E Residents And Sme Owners